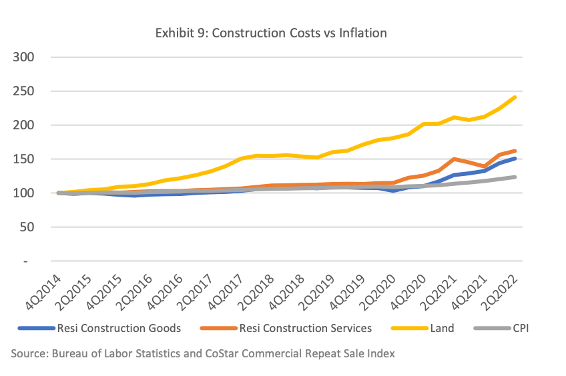

Pricing and demand have an inverse relationship, all else being equal; as costs rise, demand falls. This has been especially true in the construction sector. Since 2017, costs associated with building new housing rose faster than general inflation, as shown in Exhibit 9. These dynamics limit the ability of developers to construct moderately priced product. Increased costs can also halt new construction altogether, on occasion, as projects become unprofitable to continue.

As exhibited to the right, inputs to the residential construction — goods, services, and land — increased more rapidly than inflation, at an average annual pace of 1.6% versus inflation’s 0.7% since 4Q2014. Land prices in particular have driven this phenomenon, accounting for 56.8% of the growth in these inputs’ costs, according to Kingbird Analysis of Federal Reserve Bank of St. Louis, Bureau of Labor Statistics, and CoStar Commercial Repeat Sale Index Data.

As exhibited to the right, inputs to the residential construction — goods, services, and land — increased more rapidly than inflation, at an average annual pace of 1.6% versus inflation’s 0.7% since 4Q2014. Land prices in particular have driven this phenomenon, accounting for 56.8% of the growth in these inputs’ costs, according to Kingbird Analysis of Federal Reserve Bank of St. Louis, Bureau of Labor Statistics, and CoStar Commercial Repeat Sale Index Data.

These long-term cost increases, when combined with the above-described zoning, land use, and environmental, regulations, have a direct effect on housing supply; as building materials become more costly and restricted, the economics of constructing housing, especially affordable housing, become more challenging and less feasible.

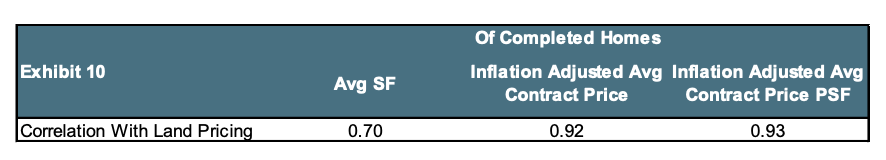

For instance, as land prices increased, single-family homes have progressively become larger and more expensive over time, even as lot sizes have declined in size. Between 1998 and 2021, land prices increased 327.8% cumulatively. Simultaneously, the average square footage, construction price, and per square foot construction price increased 26.2%, 160.82%, and 106.64%, respectively. In comparison, CPI increased 66.2% during this period, according to Kingbird Analysis of US Census Bureau Data. Further, as Exhibit 10 shows, size and contracted construction pricing a highly correlated with land cost.

Despite the above, the average lot size of single-family homes has declined from 1.74 acres in 2009 to 0.90 acres in 2021, according to Kingbird Analysis of US Census Bureau Data.

Decreased lot sizes are a direct result of a combination of strict and proliferating regulations and increasing costs; regulations dictate the size, number, and type of housing that can be built on a plot of land, limiting the ways in which builders can make up for the increased input costs of construction, thus forcing them to build larger, more expensive housing to recoup costs. Without regulations that, for example, require a given plot of land to only have one single-family home, a builder would be able to build two single-family homes or attached townhomes. This would allow builders to create additional but less expensive homes while still earning a profit.

Multifamily development is experiencing its own set of regulatory headwinds as shown by the decline in multifamily building deliveries nationwide. As previously mentioned, in 1994, 23,000 multifamily projects were completed in the US, compared to only 12,000 delivered in 2021. The lack of multifamily development is unlikely to be resolved in the near future, as many regulations intentionally block development due to negative associations with overcrowding, affordable housing, and the potential to change the landscape of neighborhoods, according to the National Library of Medicine NIMBYism as a barrier to housing and social mix in San Francisco 2022.